According to the National Association of Manufacturers for Food and Care of Companion Animals (ASSALCO), roughly half of all Italian households include either a dog or cat. Pet owners in Italy increasingly consider their pets to be part of their families, to the point that their presence influences several aspects of their lives, such as the holiday decision-making process.

Italy spends far less on pets than other developed countries. In fact, Italy is amongst the bottom four in terms of expenditure per pet in the developed world, ahead of only the United Kingdom, Taiwan, and the Netherlands. The main driver for the market is the humanization of pets wherein human characteristics are ascribed to pets and they are treated similarly. This trend resulted in an increased focus on pet health, nutrition, weight, and overall wellness.

Scope of the report

Pet Food is the animal feed that is commercially prepared, intended for consumption by pets, Italy Pet Food Market is segmented by Product Type (Dry Food, Wet Food, Treats/Snacks, and Others), By Animal Type (Dogs, Cats, Birds, and Others), & By Distribution channel (Specialized Pet Shops, Supermarkets/Hypermarkets, Online Channel, and Other Channels).The report offers the market size and forecasts in terms of value in USD million for all the above segments.

Key Market Trends

Humanization of Pets

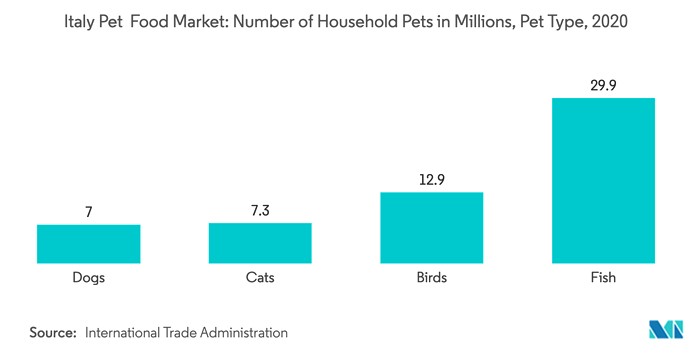

According to the National Association of Pet-Food and Pet-Cared Care Companies (ASSALCO), there are around 60 million pets in the country, with a dog population of 6.9 million, dogs are the second most popular pets in the country accounting for 46.5% of the pet food market. Cats, with a population of 7.4 million, dominate 53.5% of the market. The number of pets in Italy has been on an increase in recent years. It is also anticipated that approx 43% of Italians own at least one pet. Modern Italian families increasingly have pets for companionship.

This new role is a result of Italy's changing demographics, family structure, and general regard for animals. As said above, the increased number and importance of pets translates into greater care and into higher expenditures for food, health, accessories, and services. The latest industry figures indicate that the Italian pet food market's growth potential remains significant. According to studies, this is because 60% of Italian pet owners feed their pets with commercial pet food, rather than homemade food or leftovers.

Highly Regulated Pet Food Import

According to the International Trade Centre (ITC), France, Germany, Thailand, and Hungary are the major exporters of pet food for Italy. Import in terms of value is significantly increasing in the Italian market from USD 611,487 thousand in 2017 to USD 683,710 thousand in 2019. Pet food is highly regulated in the European Union to conform to the highest standards of hygiene, safety, and quality. In the European Union, pet food is subject to feed marketing legislation and veterinary legislation. Its feed marketing legislation covers food for pets as well as feed for food-producing animals.

Accordingly, Pet food products containing an animal origin ingredient must be sourced from approved establishments and have to be accompanied by a veterinary certificate. All exports of pet food to the European Union must comply with European Union requirements including rules on labeling, hygiene, animal health, certification, and the use of additives. The pet food exporters must verify the full set of import requirements with their European Union customers. Final import approval is subservient to the importing country's rules as interpreted by border officials at the time of product entry.

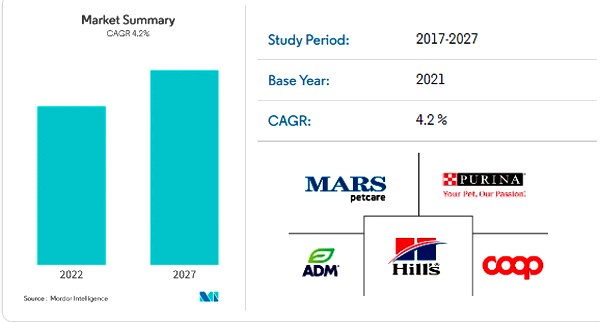

Competitive Landscape

The major companies in Italy's pet food market are Coop Italia, Mars, Nestle, Colgate- Palmolive, and Archer Daniels Midland (Neovia). The top five grocery retailers only account for one-third of the market, with the largest share going to Coop Italia. Both multinationals and local companies are increasing their research and development (R&D) to provide more specialized products that accommodate the varying demands of pet owners. Specialist channels like pet shops and pet superstores have seen an increase in share, mainly due to an increasing consumer appreciation for super-premium products, which are often only available through these channels.

Major Players

- Coop Italia

- Mars Inc.

- Nestle Purina Petcare Company

- Hill's Pet Nutrition

- Archer Daniels Midland

Recent Development

In June 2020, Nestlé Purina launched Pro Plan LiveClear, a breakthrough diet, which is the first and only cat food to reduce the allergens found on cat hair and dander across Europe including Italy. In March 2020, United Petfood acquired the Italian company, Effeffe Petfood, to strengthen its position in the country.

Source: Mordor Intelligence

You could be interested: Extrusion Seminar – Extru Tech 2024: An all-inclusive experience!

Market Information

19/04/2024

Symrise Pet Food's palatant plant located in Chapecó – SC obtained the FSSC 22000 Certification

17/04/2024

Industry round-up: latest efforts by pet food players to fuel production capabilities

15/04/2024