The coronavirus has impacted all possible areas and industries. To a greater or lesser extent, for better or for worse, all sectors of the global market have been affected, and this is an undeniable fact.

In this article we tell you what the projections are for 2021, the first year post-coronavirus, and how the pandemic has, finally, changed what is expected and required for the pet food industry.

The size of the Pet Industry

Due to the increasing trend of people to adopt / buy pets, the industry has seen tremendous growth in recent years. The surprising thing is that, even despite crises and recessions, the expansion does not stop, and this is mainly due to:

• The growing multigenerational appeal of pets.

• Appreciation of pets as members of the family.

• Greater awareness of the importance of animal welfare and health.

• The digital celebration of pets.

However, all the statistics, estimates and projections that had been made in previous years will have to be readjusted due to the exceptional situation we are experiencing this year: a streaming pandemic.

In the United States, for example, 10% of cat owners and 9% of dog owners adopted a pet due to confinement and the situation caused by COVID-19; 10% of all of them adopted or bought a pet in the last three months.

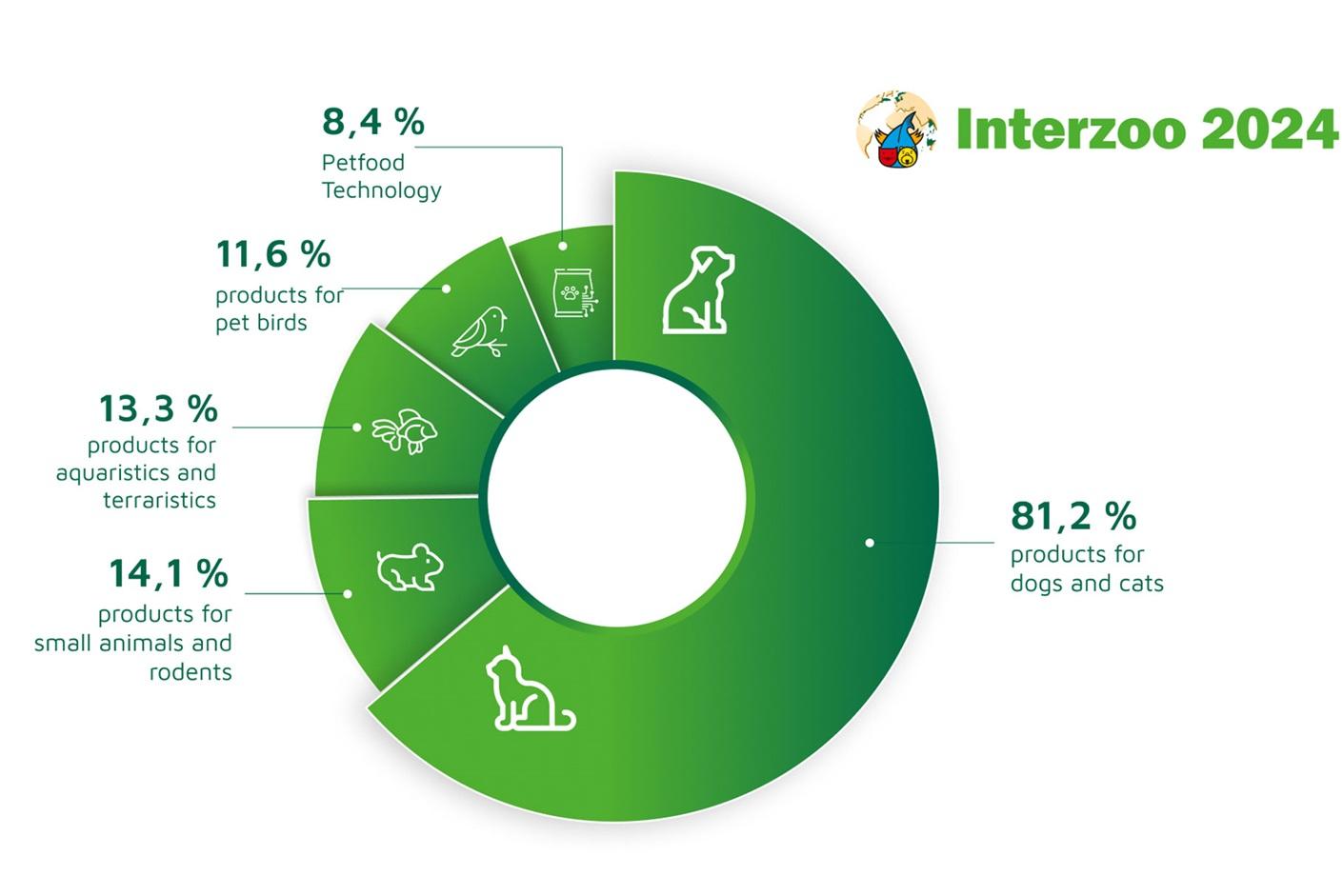

Within the global pet care industry, the food and snack industry in particular is expected to see the largest segment earnings due to the growing demand for premium, natural and organic products.

The context in Latin America

The fact is imminent: pets are destroying all kinds of judgment and stereotype, and every day hundreds of animals are adopted internationally. It seems that, finally, the taste for pets (cats and dogs at the top) crosses generations, ideology and fashions.

Pets are here to stay

Let's talk about Latin America: In 2017 there were 670 million pets worldwide, while by 2022 it is estimated that there will be 730 million, which implies a growth of 9% (60 million).

For its part, of this growth, it is estimated that 45% will happen in Latin America. It is expected that, in this region of the world, the number of cats will increase by 28% (47 million) and by 72% (115 million) that of dogs, respectively.

Argentina and Mexico are the places in the world with the highest density of pets: more than 80% of households have at least one dog or one cat. The largest number of pet owners are women between the ages of 18 and 29.

The main markets in the region are Mexico and Brazil. The latter, a large producer of dry food worldwide, will receive a great boost due to both the increase in pets at the national level and the increase in demand for exports.

Projections for 2021

• In 2018, the global pet food industry was valued at 83.02 billion dollars; Currently, after all the changes that occurred in 2020, the industry is expected to see a compound annual growth rate of 4.5% by 2025. So by 2025, the industry is expected to reach $ 90.4 billion.

• Packaged Facts states that a growth path and sales increase is expected by 5.5% in 2021 and 2022, followed by 5% in 2023 and 2024.

• Packaged Facts also projects that the food and treat market will increase its offerings for cats especially, since historically more attention has been given, in this regard, to dog snacks. Cat owners are increasingly demanding a wider variety of products, with specific, more natural formulas and supplements, among other things.

What will consumers value?

• Quality: Premium quality and natural pet products will continue to drive growth in the industry as owners increasingly take an interest in the well-being and thoughtful care of their animals.

• Communication: It will be essential to pay special attention to the way in which we communicate with potential buyers. The competition is getting bigger, so the more specific and honest the brands are, the more loyal customers they will have. A packaging that informs and advises, transparent labels and digital platforms that provide valuable information, among others, are key factors when it comes to differentiating ourselves in the market.

According to a survey by Mondi Dow Premium:

"77% of those surveyed consider it very important that the packaging contains clear nutritional information."

• More cereals: After the research carried out on dilated cardiomyopathy (to the article that deals with this topic) and the possible causal factors, cereals take on a new and interesting participation in pet food, so that alternative formulas with material raw such as quinoa, millet, chia and buckwheat.

• Electronic commerce: Consumers have had to turn to online shopping due to the pandemic. A large part will go back to physical store purchases; However, a large percentage will remain in electronic commerce and online stores, due to the convenience they provide: you do not have to carry heavy bags to the car or door, you do not have to depend on going to buy with Someone to help bring the bag of food which, while cheaper, is also more cumbersome to transport. Online pet food delivery offers not only convenience, but also a different experience: brands can profit by sending packaging with pet names, personalized gifts after a certain amount of purchases, etc., and thus maximize the user experience.

• Sustainability: Yes, we will have to make friends with this word, because from now on it will be a trend, and thank goodness! As a result of growing environmental concerns, consumers will value sustainability or environmental impact throughout the production and supply process of the food of their choice. From the marketing teams, it will be essential to take into account communicating the ingredients, the sustainability and recycling actions adopted, the way to reuse and recycle the packaging in which the food comes, among others.

Research carried out by Mondi Dow Premium found that:

'Seven out of 10 environmentally conscious pet owners prefer brands that reflect their beliefs. Likewise, 1 in 3 owners affirm that they would switch to a brand that offers a more sustainable packaging'.

In conclusion

The popularity of pets has and will undoubtedly have a positive impact on the market and will contribute to its growth in a significant way. The growing trend of humanization and growing concerns for the health and well-being of pets are causing Latin America to gain more and more participation in the international Pet Food market.

How will you prepare to take advantage of the trends that are coming for 2021?

Let us know!

Source: All Pet Food

You could be interested: Symrise Pet Food's palatant plant located in Chapecó – SC obtained the FSSC 22000 Certification

About author

María Candelaria CarbajoTranslator and editor. I collaborate with businesses and purposeful projects that want to improve their written communication, transmit their differential values, and connect with their audience. I enjoy teamwork and joining forces, experiences, and knowledge to bring to the world all the potential of businesses that seek to make an impact with their services, products, or experiences.